minority tax pros cost

YEARS IN BUSINESS 908 756-1400. Please do not submit more than one application and do not.

Tax Proposals Under The Build Back Better Act Version 2 0

To be approved and certified as a minority-owned business also referred to as a certified disadvantaged business under the SBAs 8a Business Development program eligibility requirements an organization must.

. We invite you to call our office at 973-403-1040 if you have any questions. We are excited to be serving the Las Vegas community and beyond. In-Training December 12 2017.

The Tax industry is quickly changing from year to year. Modern Upgrade has updated their hours and services. - I learned to care more for people since I had the one on one experience.

See reviews photos directions phone numbers and more for Tax Pros locations in Plainfield NJ. We are a completely remote tax service that provides a variety of financial services such as credit and audit pro we can even get you a cash advance of up to 6000 on your tax return. Seems to good to be true and I can find very little reviews on them other than 3 reviews on Glassdoor.

In 2012 three-fourths of white families owned a. Tax Services Cost Guide. Minority Tax Pros has been serving the community for 14 years with certified tax professionals preparing taxes for the minority community.

They pay a set amount for each tax return and their training course is only 5 hours and then you take an exam 95 pass rate according to them. - My co-workers were very energetic and positive people that will make everyday at. Service Offerings in Las Vegas.

Not Just During Tax Season. Also to listen and take care of each person need as an individual. What are you looking for.

Tax Pros Income Tax Service. Great after sales service. Free price estimates for Accountants.

For years Minority Tax Pros MTP have been providing hungry entrepreneurs with a FREE business in a box. 673 people follow this. He did landscaping for me top soil and seeding.

MTP has become one of the fastest growing service providers in the nation. Minority Tax Pros Association All Rights Reserved. Ad Real prices from top rated Accountants near you.

1 in Customer Service. Minority Tax Pros Reviews Photos Phone Number And Address Legal Services In. And he comes back to check the progress.

250 likes 1 talking about this. Personal financial information including tax returns and. The overtime spent on diversity initiatives comes at a cost for minority faculty a toll known as the minority tax.

Free estimates no guessing. Ad Tax Advisory Services with Dedicated Tax Consultants and a Flexible Suite of Services. Glassdoor gives you an inside look at what its like to work at Minority Tax Pros including salaries reviews office photos and more.

With currently over 11000 members across the country MTP is a proud leader in the income tax creation services industry. Please complete the form Submissions may take up to 48 hours to review. However racial minorities are less likely to own a home and if they do tend to own one of lower value.

Contact Minority Tax Pros on Messenger. A tax is an imposed compulsory contribution to a. After watching the video please complete the form and a representative will contact you.

The major benefit to being a member of the Association is that we will teach you everything you need to know from A-Z. Herminio is the real deal. See more of Minority Tax Pros on Facebook.

We offer an introductory consultation at no cost or obligation. There is no cost to become certified under SBA 8a guidelines. I can get you cash advances up to 6000 credit repair up to 200 points audit protection and car buying at.

Tax Planning and Preparation QuickBooks Consulting Services Entity Selection and New Business Advisor Business and Financial Consulting Services Outsourced Controller and CFO Services IRS Problem Resolution. Established in 2006. This video explains what the MTP Association is about and how you can be your own Boss with a successful Income Tax business.

After watching the video please complete the form and a representative will contact you. 666 people like this. These programs cost the federal government over 300 billion dollars in 2015.

Black and brown faculty bear the burden of the minority tax an array of additional duties expectations and challenges that accompany being an exception within white male-dominated institutional environments. Get a free estimate today. This video explains what the MTP Association is about and how you can be your own Boss with a successful Income Tax business.

When Governor Whitman proposed increasing the cigarette tax by 25 cents a pack last December she did so to help pay for hospital care. Build an Effective Tax and Finance Function with a Range of Transformative Services. They offer their members everything they need to become a Certified Tax Professional.

We are rapidly increasing our presence and recognition with our unique approach to the industry. But has anyone ever heard of Minority Tax Pros Association. Start crossing things off your list today.

Tax Offices Near Me. Tax season can be a little overwhelming to many. 2 reviews of Modern Upgrade You want to stop shopping around.

Over 100 years since the 1910 Flexner Report resulted in the closure of all but two. 5 out of 5 stars. Be Your Own BOSS.

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Tax Breaks For Minority Owned Businesses

2020 Tax Software Survey Journal Of Accountancy

The Time Tax Put On Scientists Of Colour

Consolidated Group Tax Allocation Agreements The Cpa Journal

Amazon Com The Black Tax The Cost Of Being Black In America Ebook Rochester Shawn D Books

The Race Card From Gaming Technologies To Model Minorities Postmillennial Pop 22 Fickle Tara 9781479805952 Books Amazon Com

Capitol Recap Georgia May Be Majority Minority State Within A Decade

How The U S Tax System Disadvantages Racial Minorities The Washington Post

2020 Tax Software Survey Journal Of Accountancy

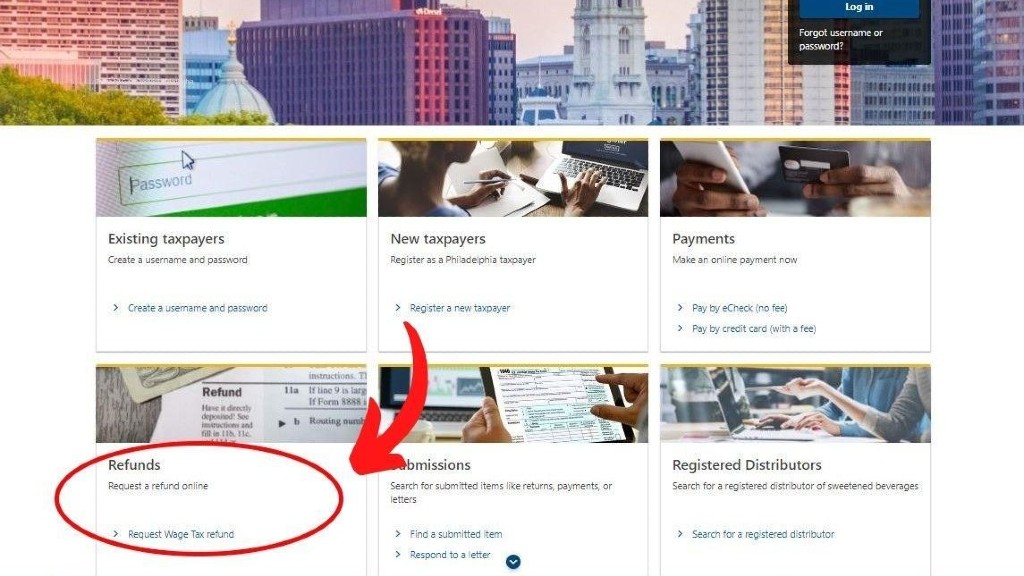

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

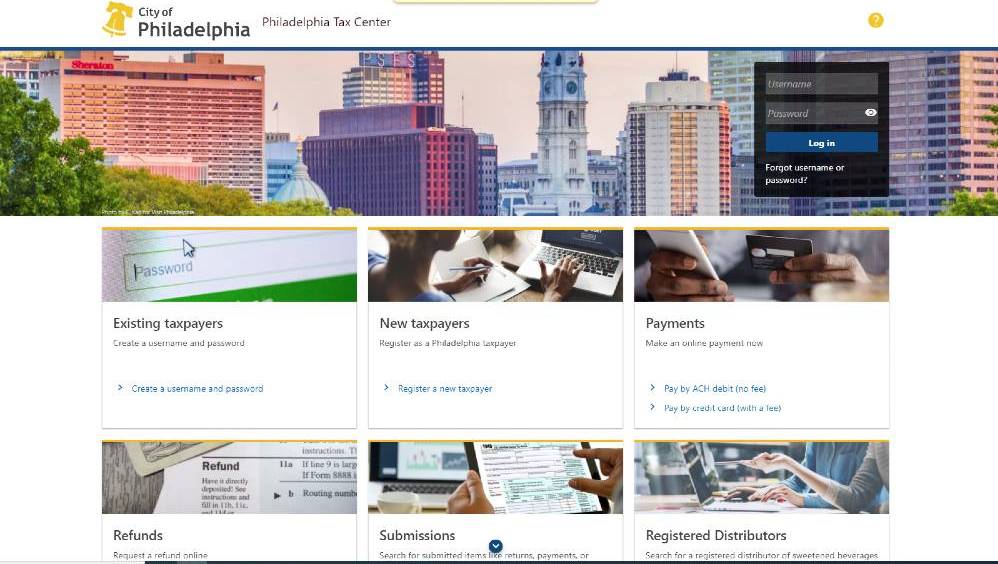

Log In To The Philadelphia Tax Center Today Department Of Revenue City Of Philadelphia

Consolidated Group Tax Allocation Agreements The Cpa Journal

29 Crucial Pros Cons Of Taxes E C

:max_bytes(150000):strip_icc()/dotdash_Final_How_To_Calculate_Minority_Interest_Oct_2020-01-54830679f6a34b8581810db05d008661.jpg)

How To Calculate Minority Interest

Obstacles To Implementing The Rights Of Minorities And Early Effective Conflict Prevention Minority Rights Group

H R Block S Newsroom Source Of Company And Tax News H R Block

/renting-vs-owning-home-pros-and-cons.asp-ADD-V2-2ce9de919eb94f62bd4e4c7a23010852.jpg)